Archive for the ‘Phil Gramm’ Category

December 14, 2009

Eighth anniversaries are “Bronze Anniversaries,” and there have been few events more brazen than the collapse of the Enron Corporation. It happened eight years ago, and this groundbreaking cataclysm would not have been possible without the assistance of Wendy Gramm, PhD.

As Chairman of the Commodity Futures Trading Commission (CFTC), Dr. Gramm ended governmental oversight of energy derivatives traded by Enron and other companies. Six days after leaving government, she was named to the Enron board of directors, where she headed the Audit Committee and was paid a million or two by the rogue corporation.

(more…)

Tags:deregulation, economics, Enron, finance, Phil Gramm, Republicans, UBS, Wendy Gramm

Posted in business, finance, Phil Gramm, Republicans, Wendy Gramm | 3 Comments »

April 2, 2009

Senator John McCain, speaking for Republicans because Rush Linbaugh was busy, presented his party’s fiscal year 2010 federal budget counter-proposal in words of two letters, all of them spelled “N-O.”

(more…)

Tags:Cindy McCain, economy, Federal Budget, financial crisis, GOP, McCain, Phil Gramm, politics, Republicans, Wendy Lee Gramm

Posted in banking, Cindy McCain, Congress, economics, finance, government, John McCain, McCain, news, Phil Gramm, Real Estate, Republicans, Wendy Gramm | Leave a Comment »

February 17, 2009

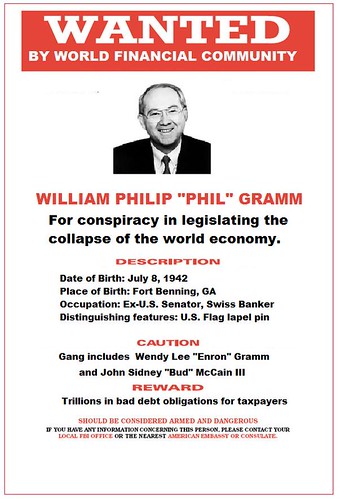

Time picked the “25 People to Blame for the Financial Crisis” and invites you to rank-order the most culpable meltdown miscreants. Number one to date is – no surprise – Texas Republican and Swiss banker Phil Gramm, PhD.

Here are the current poll standings for these polecats, and Time’s rationale for the feature.

Image by Mike Licht. Download a copy here. Creative Commons license; credit Mike Licht, NotionsCapital.com

Comments are welcome if they are on-topic, substantive, concise, and not obscene. Comments may be edited for clarity and length.

Tags:economy, financial crisis, media, Phil Gramm

Posted in banking, celebrities, criticism, economics, ethics, finance, insurance, media, Phil Gramm, Real Estate, Republicans, stock market, Time Magazine | Leave a Comment »

December 31, 2008

Robert O’Harrow Jr. and Brady Dennis of the Washington Post penned a detailed account of how “credit default swaps” helped bring down the world economy. Monday’s installment deals with the genesis of the unholy instruments; Tuesday’s chapter covers the way AIG Financial Products applied them and undermined the global financial system.

Time’s Justin Fox puts part two in perspective. Highlights:

(more…)

Posted in banking, business, economics, finance, gambling, insurance, Phil Gramm, Republicans, stock market, Time Magazine, Washington Post | 2 Comments »

November 25, 2008

Neil Irwin and David Cho of the Washington Post report this historical note:

In the 1920s, a firm called First National City Bank started repackaging bad loans from Latin America and selling these to investors as safe securities. These investments collapsed in grand fashion after the 1929 stock market crash and eventually led to a new wave of securities regulation. National City Bank became Citibank, which in turn became a major unit of Citigroup.

No wonder Citigroup keeps changing its name.

Doctrinaire Republican market-worshippers “deregulated” those depression-era securities protections eight years ago. Were the consequences so surprising?

“Those who cannot learn from history are doomed to repeat it,” said George Santayana. If Santayana is too difficult for our leaders, perhaps they can heed the words of philosopher Lawrence Peter “Yogi” Berra:

“You can observe a lot just by watching.”

” A nickel isn’t worth a dime today.”

“You’ve got to be very careful if you don’t know where you’re going, because you might not get there.”

Full disclosure: For three years back in the last century, writer Mike Licht held a scut job at the compliance office of Citicorp Investments.

Note: While many adages are attributed to Mr. Berra, not all have been verified, and half the lies they tell about him aren’t true.

Posted in banking, Baseball, Bush, business, economics, finance, George W. Bush, government, history, media, news, Phil Gramm, Republicans, stock market, Washington Post, Wendy Gramm | Leave a Comment »

November 18, 2008

“When I am on Wall Street and I realize that that’s the very nerve center of American capitalism and I realize what capitalism has done for the working people of America, to me that’s a holy place.”

“This is part of this myth of deregulation. By and large, credit-default swaps have distributed the risks. They didn’t create it. The only reason people have focused on them is that some politicians don’t know a credit-default swap from a turnip.”

“They are saying there was 15 years of massive deregulation and that’s what caused the problem. I just don’t see any evidence of it.”

— Texan Swiss banker and former Senator Phil Gramm, quoted by Eric Lipton and Stephen Labaton (with Griff Palmer) in “The Reckoning: Deregulator Looks Back, Unswayed,” New York Times, November 16, 2008.

(more…)

Posted in banking, business, Congress, economics, government, New York Times, news, Phil Gramm, religion, Republicans, satire, stock market, Texas, theology, transparency | 4 Comments »

November 17, 2008

Swiss Banking giant Union des Banques Suisse (UBS, un établissement financier mondial, fondée 1747) will not pay annual bonuses to top executives, report Ben White and David Jolly in the New York Times. Does that include UBS Vice-Chairman William Philip “Phil” Gramm, PhD., the man who deregulated the world economy into catastrophy?

(more…)

Posted in banking, business, Congress, economics, family, finance, holidays, New York Times, news, Phil Gramm, privacy, Republicans, Texas, Wendy Gramm | 2 Comments »

October 24, 2008

Fallen financial deity Alan Greenspan, long-time Chairman of the U.S. Federal Reserve Board, appeared before a Congressional committee yesterday, admitting his errors in under-regulating swaps and derivatives markets and assuming the new types of banks and financial services companies spawned by Phil Gramm‘s deregulation spasm would police themselves. Dr. Gramm, now a Swiss Banker, is Sentor John McCain’s chief economic advisor.

Republican Presidential Candidate McCain has repeatedly mentioned Mr. Greenspan in speeches since his 2000 presidential campaign, usually in conjunction with the 1989 film Weekend at Bernie’s:

(more…)

Posted in banking, economics, films, finance, John McCain, McCain, news, Phil Gramm, presidential politics, Republicans, rhetoric, stock market | Leave a Comment »

October 14, 2008

Senators John McCain and Barack Obama are preparing for tomorrow’s third and final 2008 Presidential Debate by cramming on economic and financial issues. There is a slight catch: their economic and financial advisors are the schmucks who destroyed the world economy.

Senator Obama has an easier time, as Republicans in the White House and Congress were the active movers in this catastrophe. Then again, ranking Democrats just let it happen.

(more…)

Posted in Barack Obama, Democrats, economics, finance, George W. Bush, John McCain, McCain, news, Palin, Phil Gramm, presidential politics, Republicans, satire, stock market, television | Leave a Comment »

October 8, 2008

Senator John McCain’s “town hall” debate mortgage distraction isn’t new, isn’t his, and is not sufficient to stem the collapse of the U.S. economy. It is a another McCain tactical distraction meant to keep the discussion away from assessing blame for this financial debacle. Understandable, since the finger points to Senator McCain and those close to him who made “deregulation” an article of faith and pursued it with religious fervor. They got it, so we got this crisis.

The $700 billion financial rescue package already provides for mortgage mitigation. The current administration’s “Paulson Plan” is three-fold, calling for stabilization of the financial sector, removing bad mortgages from the picture, and launching some sort of general economic stimulus program. So much for the argument that a McCain Administration would not be a four-year extension of Bush policies.

(more…)

Posted in banking, economics, finance, George W. Bush, government, Housing, insurance, John McCain, McCain, news, Phil Gramm, presidential politics, Real Estate, Republicans | Leave a Comment »